What is Dollar General payroll? Welcome to our in-depth exploration of Dollar General’s payroll system. In the realm of retail giants, understanding the intricacies of payroll management is paramount. Dollar General, a prominent player in the industry, relies on a comprehensive payroll structure to compensate its workforce effectively. In this blog, we are going to discuss what is Dollar General Payroll, its significance & procedure, and the factors influencing it.

What Do You Mean by Dollar General Payroll?

Dollar General payroll refers to the comprehensive system and processes put in place by the retail giant to manage the compensation of its workforce. This system encompasses the calculation, distribution, and management of wages and benefits for employees across its extensive network of stores and facilities. At its core, Dollar General payroll ensures that employees are accurately and promptly remunerated for their labor and services rendered to the company.

The Significance of Dollar General Payroll

The significance of Dollar General payroll cannot be overstated, as it serves as the backbone of the company’s operations and reflects its commitment to its workforce. Here’s why Dollar General payroll holds paramount importance:

Employee Satisfaction and Retention: A reliable and efficient payroll system is instrumental in fostering employee satisfaction and retention. Timely and accurate payments demonstrate the company’s respect for its employees’ contributions, fostering a positive work environment and encouraging employee loyalty.

Compliance with Regulations: Dollar General payroll ensures compliance with federal, state, and local regulations governing wage and hour laws, tax requirements, and employee benefits. Adhering to these regulations mitigates legal risks and safeguards the company’s reputation as a responsible corporate citizen.

Financial Management and Accountability: The payroll system serves as a crucial component of Dollar General’s financial management, allowing for accurate tracking of labor costs, budgeting, and financial reporting. Effective payroll management enhances financial transparency and accountability, enabling the company to make informed decisions and allocate resources efficiently.

Employee Benefits Administration: In addition to wages, Dollar General payroll oversees the administration of employee benefits, including health insurance, retirement plans, and other perks. Managing these benefits effectively contributes to employee well-being and enhances the company’s attractiveness as an employer of choice.

In essence, the significance of Dollar General payroll extends beyond mere transactional processes; it reflects the company’s values, commitment to compliance, and dedication to fostering a supportive and rewarding workplace environment for its employees.

A Comprehensive Guide on Dollar General Payroll Procedure

Dollar General’s payroll procedure encompasses various steps and processes aimed at accurately compensating its employees for their work. Here’s a comprehensive guide to understanding the Dollar General payroll procedure:

Timekeeping and Attendance:

The payroll process begins with employees recording their hours worked and attendance. Dollar General utilizes timekeeping systems where employees clock in and out, either through traditional time clocks or modern electronic systems.

Payroll Processing:

Once employee hours are recorded, payroll processing begins. This involves gathering data on hours worked, overtime, and any other relevant information necessary for calculating wages.

Wage Calculation:

Dollar General calculates employee wages based on various factors, including hourly rates, overtime hours, and any applicable bonuses or incentives. Payroll administrators use this data to determine the amount each employee is owed for the pay period.

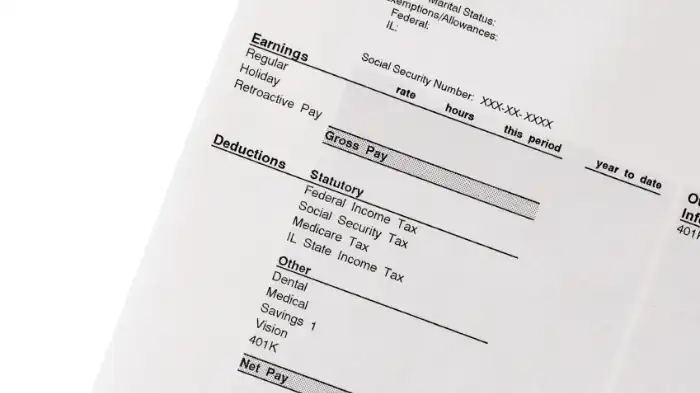

Deductions and Taxes:

Dollar General deducts various taxes and contributions from employee wages, including federal and state income taxes, Social Security and Medicare taxes, as well as any voluntary deductions such as health insurance premiums or retirement contributions. These deductions are calculated based on applicable tax rates and employee preferences.

Direct Deposit or Paper Checks:

Once wages are calculated and deductions are made, employees receive their pay through either direct deposit or paper checks. Direct deposit allows employees to have their wages deposited directly into their bank accounts, providing a convenient and secure method of payment.

Payroll Compliance:

Dollar General ensures compliance with federal, state, and local regulations governing payroll and employment practices. This includes adhering to minimum wage requirements, overtime regulations, and tax obligations.

Payroll Reporting and Record-Keeping:

Dollar General maintains accurate records of payroll transactions, including employee earnings, deductions, and tax withholdings. These records are essential for financial reporting, tax filings, and ensuring transparency and accountability in payroll processes.

Employee Benefits Administration:

In addition to wages, Dollar General administers employee benefits such as health insurance, dental and vision coverage, retirement savings plans, and employee discounts. Payroll administrators manage deductions and contributions related to these benefits.

Continuous Review and Improvement:

Dollar General continuously reviews and improves its payroll procedures to enhance efficiency, accuracy, and compliance. This may involve implementing new payroll software, updating policies and procedures, and providing training for payroll staff.

In summary, Dollar General’s payroll procedure encompasses a series of interconnected steps aimed at ensuring accurate and timely compensation for its employees while adhering to regulatory requirements and fostering transparency and efficiency in payroll administration.

Factors Influencing the Dollar General Payroll

The Dollar General payroll is influenced by several critical factors that play a pivotal role in determining how employees are compensated. Understanding these factors is essential for both employees and the company to ensure fair and accurate payroll processing.

Employee Classification:

One of the key determinants of payroll at Dollar General is the classification of employees. Different roles within the company come with varying responsibilities, skill levels, and compensation structures. For instance, a store manager and a cashier may have distinct classifications, impacting their base pay, bonuses, and benefits. This classification ensures that employees are rewarded appropriately based on their roles and contributions to the organization.

Hours Worked and Overtime:

The number of hours an employee works directly influences their compensation. Hourly employees at Dollar General are paid based on the hours they work, and any overtime is subject to additional compensation. Tracking hours accurately is crucial to ensure that employees are fairly compensated for their time and effort. Overtime pay is typically provided for hours worked beyond the standard workweek, adhering to labor regulations.

Payroll Regulations and Compliance:

Dollar General, like any responsible employer, adheres to a myriad of federal, state, and local payroll regulations. These regulations encompass minimum wage requirements, overtime rules, and tax obligations. Compliance with these laws ensures that the company operates ethically and avoids legal complications, guaranteeing that employees receive their due compensation in accordance with established guidelines.

Employee Benefits and Bonuses:

Beyond base pay, Dollar General offers various employee benefits and bonuses that impact overall compensation. These may include health insurance, dental and vision coverage, retirement plans, and performance-based bonuses. The availability and extent of these benefits can vary based on factors like job position, length of service, and individual performance, adding a layer of complexity to the overall payroll structure.

In summary, the Dollar General payroll is shaped by the unique combination of employee classifications, hours worked, compliance with regulations, and the array of benefits and bonuses offered. A meticulous consideration of these factors ensures that Dollar General maintains a fair and competitive compensation system, fostering a positive and motivated workforce.

Frequently Asked Questions

What is Dollar General Payroll, and How Does It Work?

Dollar General payroll refers to the system and processes through which the company compensates its employees for their work. It involves various stages, including recording employee hours, calculating wages, and processing payments. The payroll system ensures that employees receive accurate and timely compensation for their services.

How Does Dollar General Handle Payroll Taxes and Deductions?

Dollar General deducts various taxes and contributions from employee wages, including federal and state income taxes, Social Security and Medicare taxes, as well as any voluntary deductions such as health insurance premiums or retirement contributions. These deductions are calculated based on applicable tax rates and employee preferences.

How Does Dollar General Ensure Payroll Compliance with Regulations?

Dollar General adheres to federal, state, and local regulations governing payroll and employment practices. The company invests in robust payroll software and systems to ensure accuracy and compliance with relevant laws, including minimum wage requirements, overtime regulations, and tax obligations.

What Measures Does Dollar General Take to Ensure Payroll Accuracy?

Dollar General employs various measures to ensure payroll accuracy, including regular audits, checks, and balances within the payroll system. Additionally, payroll administrators undergo training and follow standardized procedures to minimize errors and discrepancies in employee compensation.

How Does Dollar General Address Employee Concerns or Disputes Regarding Payroll?

Dollar General has established protocols for addressing employee concerns or disputes regarding payroll. Employees can reach out to their supervisors or human resources department to seek clarification or resolution regarding any payroll-related issues they may encounter.

Conclusion

In conclusion, understanding what Dollar General payroll entails is crucial for employees, investors, and stakeholders alike. Dollar General payroll, a multifaceted system encompassing compensation, benefits, and compliance, underscores the company’s commitment to its workforce and operational excellence. By delving into the intricacies of Dollar General payroll, we uncover its significance in fostering employee satisfaction, ensuring regulatory compliance, and driving financial accountability.

What is Dollar General payroll? It’s more than just a transactional process; it’s a reflection of Dollar General’s values and dedication to maintaining a fair and supportive workplace environment. As Dollar General continues to thrive in the competitive retail landscape, its payroll system remains a cornerstone of its success, ensuring that employees are duly rewarded for their contributions. In simple terms, Dollar General’s payroll system shows how dedicated the company is to its most important resource: its employees.